Some credit unions present payday substitute loans, that are smaller-greenback loans with very low interest fees that you simply repay over several months to some yr.

While income advance apps might help to go over crisis bills, You can also find some dangers to look at with utilizing them.

Your harmony could be the limit in your card that guarantees it is possible to constantly pay your equilibrium in complete, and you may make use of the automated SafePay attribute to make sure you spend on time.

Practical budgeting equipment — Apps like Existing offer a host of conserving and budgeting equipment for users.

You are able to develop a sound credit score heritage by creating normal, on-time payments. Credit score Builder Additionally also involves other characteristics to assist Construct your credit. It comes along with cost-free credit rating monitoring, letting you to track your development, and it enables you to waive the monthly administrative fee on a RoarMoney bank account, a MoneyLion investment decision account, or both of those.

Be sure to realize that Experian guidelines transform as time passes. Posts mirror Experian policy at time of composing. Even though taken care of in your information, archived posts may not replicate current Experian plan.

But while lots of of those dollars progress apps may well not cost you interest, They could have other service fees such as monthly memberships.

When you initial start off using the app, You will be capped at $a hundred for every spend period, but that Restrict could be lifted to $five hundred when you keep on to make use of the app. If you use the application ample, you may well be invited to Earnin Convey, which presents early use of approximately 80% of your paycheck or $one,000, whichever is fewer. The app may also connect to your checking account and supply alerts Whenever your balance is reduced in addition to a "stability protect" progress to keep your account from heading negative.

Money progress applications Provide you with speedy entry to money, Nevertheless they're best reserved for a single-time emergencies.

Dollars progress more info applications like the ones shown in this article don’t function using your employer — they fundamentally lend you revenue them selves before you get paid.

And that's the heart of Millennial Dollars: prevent hustling you right into a breakdown and halt squandering time by managing money improperly.

As an example, the app transfers the $a hundred you must borrow towards your checking account, and Whenever your following paycheck arrives, the app requires $a hundred directly from it to go over the cost.

Chime also consists of the SpotMe services, which allows you to overdraw your accounts as much as $two hundred with no overdraft fees. Chime will deduct the overdraft amount from a next paycheck.

Based upon eligibility, you can obtain around $five hundred sent from your ExtraCash account to the external lender in a single to three days free of charge, or you are able to transfer it right away to the Dave Debit Mastercard for a little fee.

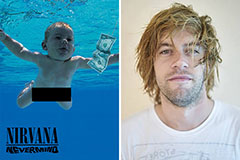

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!